child tax credit october 15 2021

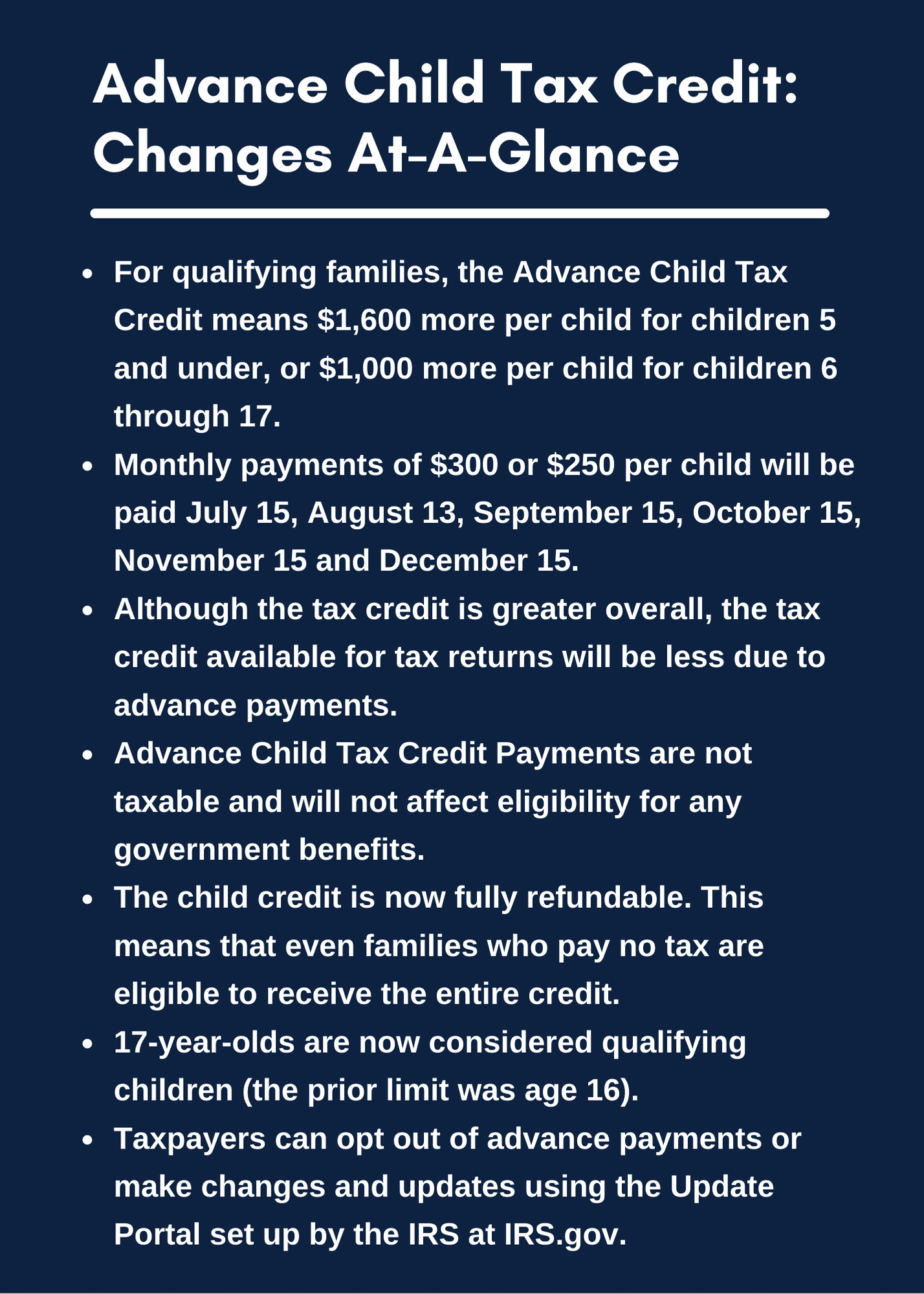

Thats an increase from the regular child tax. The CTC has been revised in the following ways.

Child Tax Credit File Your Taxes By October 17 To Claim Your 2021 Deduction Gobankingrates

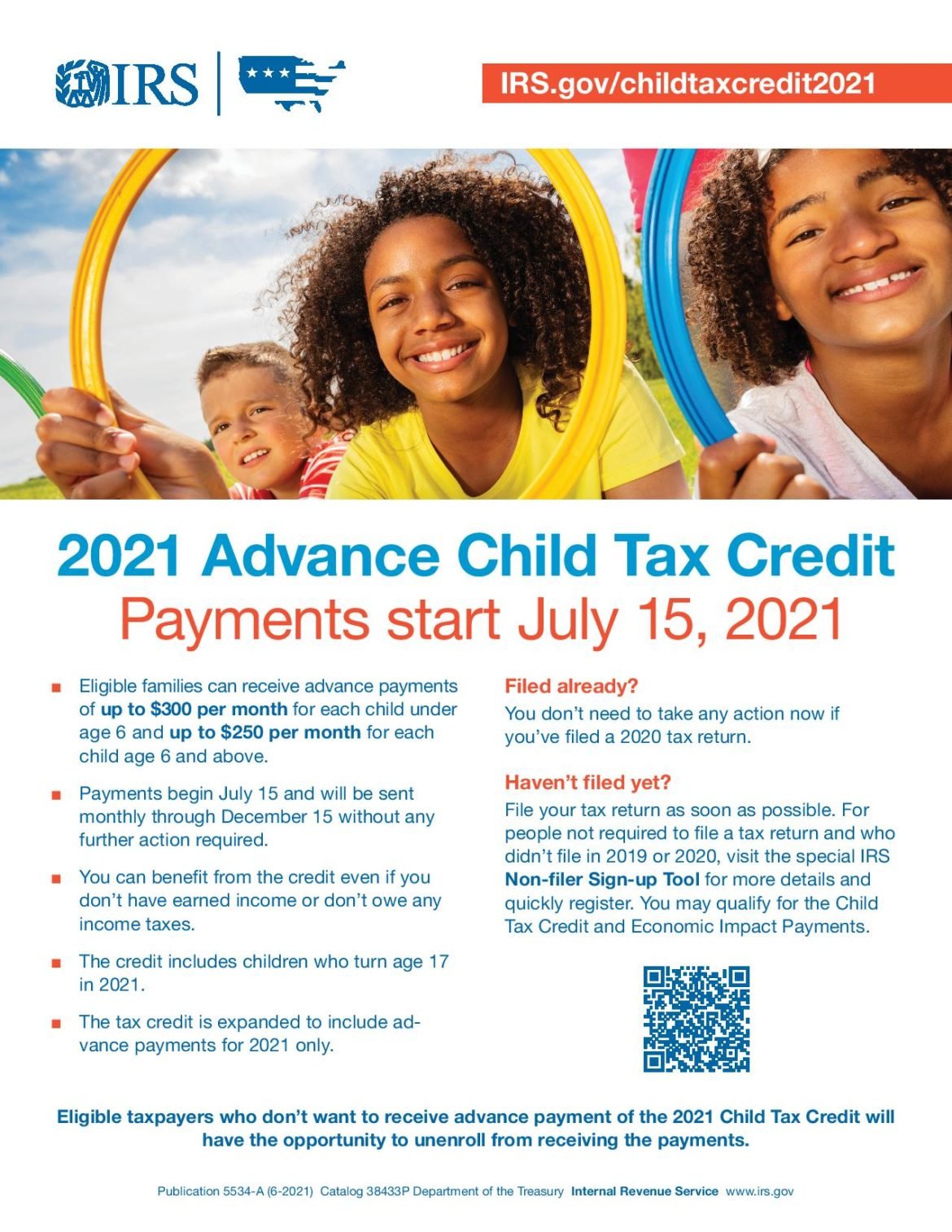

Six payments of the Child Tax Credit were and are due this year.

. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6. Checks will be sent out from October 15 and should arrive in bank accounts within days. Good news - Child Care Relief Funding 2022 is here.

10 hours agoIt was expanded in 2021 as part of President Joe Bidens 19 trillion coronavirus relief package. Thanks to the American Rescue Plan the Child Tax Credit was increased and expanded for 2021. Most families are eligible to receive the credit for their children.

For any family that is eligible to receive the tax. IR-2021-201 October 15 2021. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

15 is a date to watch for a few reasons. Half of the total is being paid as. This increased payments up to 3600 annually for each child aged 5 or under.

These changes will only apply for the 2021 tax year. On October 19 2021 the Texas Workforce Commission TWC approved distribution of 245 billion American Rescue Plan Act funds for. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The American Rescue Plan has expanded the CTC for the 2021 tax year. October 15 Deadline Approaches for Advance Child Tax Credit.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. The credit tops out at 3000 for children. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

11 hours agoOther temporary changes in 2021 included delivering 50 of the credit in advance monthly payments beginning in July 2021 and the remaining 50 claimed on a 2021 tax return. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. When does the Child Tax Credit arrive in October.

Thats an increase from the regular. What is the schedule for 2021. The IRS is paying 3600 total per child to parents of children up to five years of age.

That drops to 3000 for each child ages six through 17. Recipients can claim up to 1800 per child under six this year split into the six. The credit is worth between 250 and 300 a month per child to eligible families and was signed into law by President Joe Biden as part of the 19 trillion American Rescue.

As a result on October 15 families will receive 300 for each child aged five and under and 250 per child ages six and over. Most of us really arent thinking tax returns in mid-October. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for. The law requires nearly half of the credit to be sent in advance. The child tax credit scheme was expanded to 3600 from 2000 earlier this year.

The credit has been expanded to a maximum of 3600 per child for children under 6 years old. First families can expect some treats since the fourth round of. It depends on the age of the child.

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

/cloudfront-us-east-1.images.arcpublishing.com/gray/UI6ILF3TYZEQND3RU2UEGASAQ4.jpg)

Parents Still Have Time To Claim Their Expanded Child Tax Credit By Nov 15

Child Tax Credit 2021 What To Know About New Advance Payments

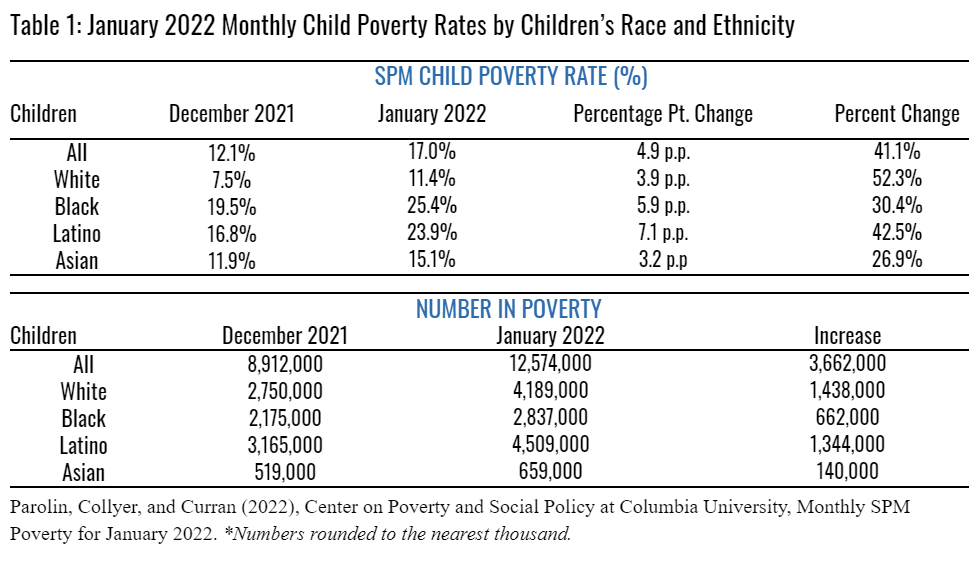

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

2021 Advance Child Tax Credit Payments Start July 15 2021 Necpa

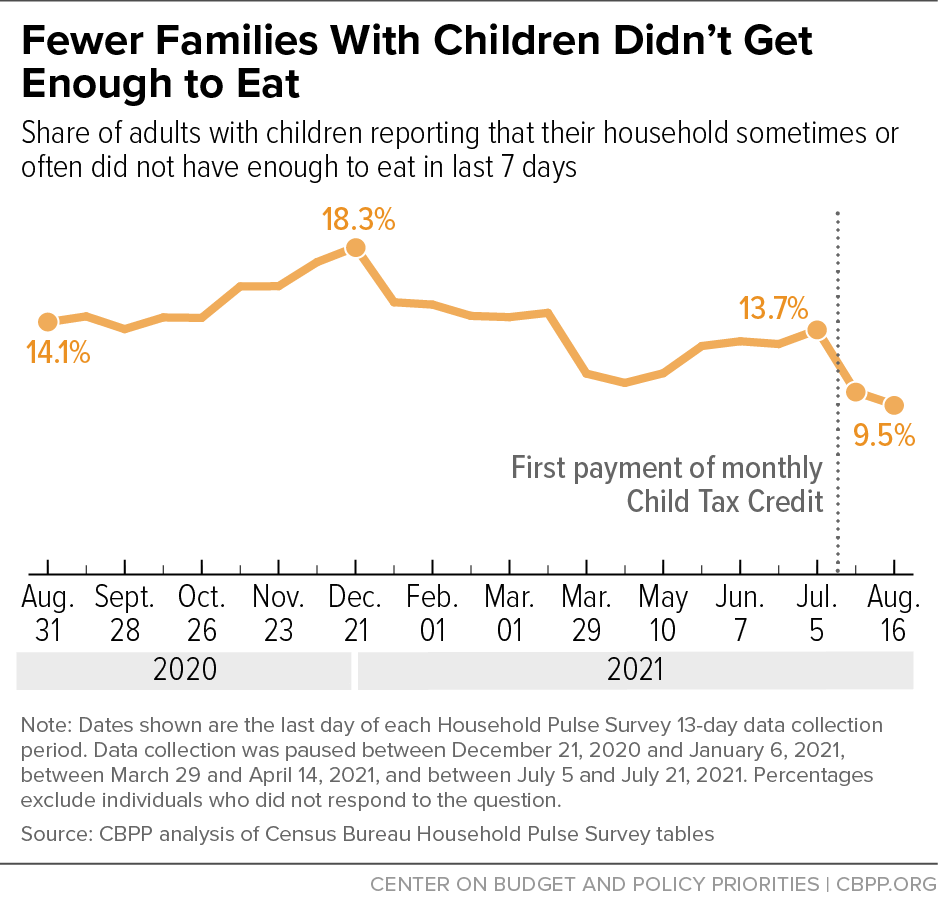

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Advance Child Tax Credit Update October 15 2021 Youtube

Stimulus Update When To Expect October Child Tax Credit Payment

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit When Will Your October Payment Show Up Cbs Sacramento

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

Expanding The Child Tax Credit Budgetary Distributional And Incentive Effects Penn Wharton Budget Model

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

It S October 15th You Know Ways And Means Committee Facebook

Helping All Eligible Families Get The Child Tax Credit Youtube

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News